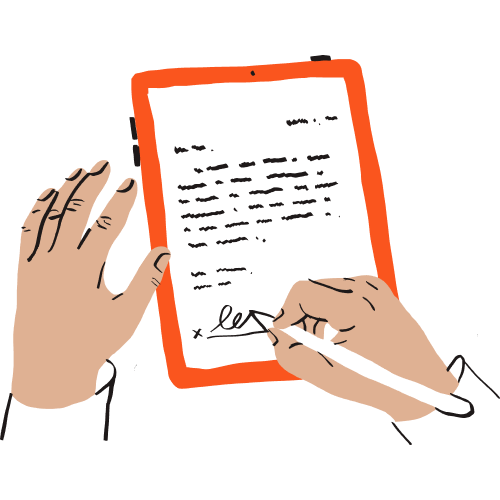

What is a Georiga promissory note?

A Georgia promissory note is a legal document that outlines the borrower's promise to repay a specific principal amount borrowed. It solidifies the promise in writing between the borrower and lender, specifying the terms and conditions, including the rate of interest and due date of the loan.